Short-Term Home Health Care Aide Benefit

Daily Benefit Amounts vary by selected plan. Benefits are payable should you have an inability to perform two or more Activities of Daily Living or have a Cognitive Impairment. A prior hospitalization stay is not required.

The maximum benefit period is 360 days**.

Plan A $50 Per Day

Plan B $100 Per Day

Plan C $150 Per Day

***Home Health Care Aide Benefit is part of the combined max daily benefit.

Restoration of Benefits

Benefits restore if covered home health care services have not been received for 180 consecutive days AND a Licensed Health Care Practitioner has certified that you have sufficiently recovered to no longer require home health care or nursing care services.

Additional Benefits to Choose From

Accident and Sickness Hospitalization Benefit Rider*

You will receive benefits of $100 up to $450 a day, regardless of the base daily benefit amount selected, should you be confined to a hospital due to an accident or sickness. You can choose a 3-day, 6-day or 10-day benefit period which will restore after 60 days of no hospital confinement. Full benefits are paid for hospital stays as long as confinement was at least 24 hours. (For Ages 75 and above, $100 to $300 a day available, for a 3-day or 6-day benefit period.)

* In ID, this Rider includes a $40 Daily Benefit for the remainder of the 31 day Maximum Benefit Period. In PA: This Rider includes a $15 Daily Benefit for the remainder of the 31 day Maximum Benefit Period.

Ambulance Benefit Rider

This rider will pay a $200 benefit for ground ambulance services to or from a medical facility, up to four times a year and subject to a lifetime maximum of $2,500. No hospitalization confinement is required.

Return of Premium Rider

This rider will return all premiums you have paid minus benefits paid in the event of your death. Refer to the outline of coverage for details. (Not available in: GA, MD, PA & TN.)

Dental and Vision Benefit Rider

This rider will pay you an annual benefit of up to $400, $800 or $1,200 for services performed by a licensed dentist, ophthalmologist or optometrist after the first year, including $200 for prescription eye glasses or contact lenses.

(Not available in: GA, ID, MD & OR .)

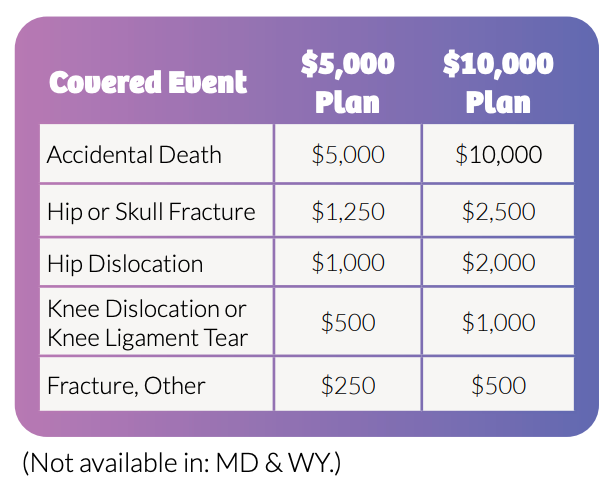

Critical Accident Benefit Rider

After an Emergency Room visit, this rider will pay a lump sum benefit for the following types of accident injuries:

Why Add Dental & Vision?

Benefits Paid

Directly to You

3 Plans to

Choose From

Benefits for

Prescription Drugs

Riders to Customize

Coverage

Support for Family

Caregivers

Frequently Asked Questions

What is short-term home health care insurance?

Short-term home health care insurance provides cash benefits to help cover the cost of qualified care services received in your home due to illness, injury, or cognitive impairment.

When do benefits become payable?

Benefits may be available if a licensed healthcare provider certifies that you are unable to perform certain daily activities or have a qualifying cognitive condition. A prior hospital stay is typically not required.

How are benefits paid?

Benefits are generally paid directly to you, giving you flexibility in how the funds are used to support home care services or related expenses.

Is there a limit to how long benefits can be received?

Coverage is designed for short-term needs and includes a maximum benefit period. In some cases, benefits may restore after a specified period without receiving covered services.

Does this coverage replace long-term care insurance?

No. This type of policy is intended to supplement healthcare coverage for temporary home care needs and is not a replacement for long-term care insurance.

Get Home Care Support

Understand Your Home Care Coverage Options

Speak with an agent to see how this coverage can help when in-home care is needed.